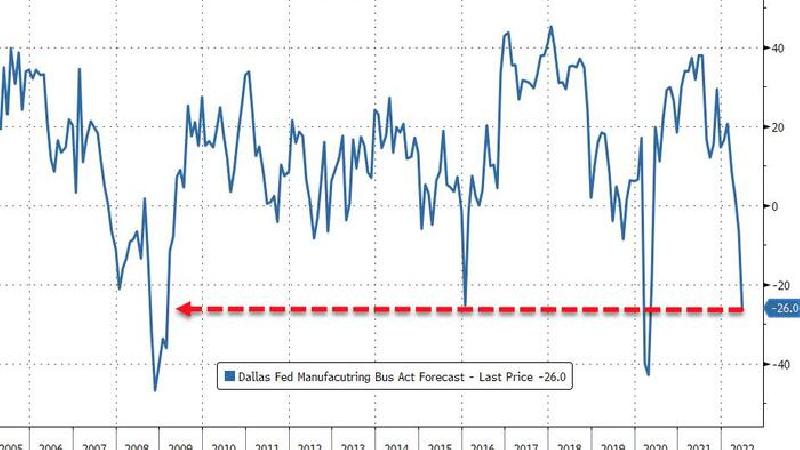

After an unexpected rise in US durable goods orders (in May) and pending home sales (in May), the Dallas Fed’s Manufacturing Survey (in June) plunged to its lowest since May 2020.

The survey was expected to rise modestly from -7.3 to -6.5, but plunged to -17.7. New Orders crashed into negative territory and employment weakened significantly.

The comments from survey respondents are perhaps most enlightening of the reality facing many businesses in America: foreign dependence, cost inflation, over-regulation, and Biden energy policies…

- As a country, we are not looking at the future and establishing relationships with emerging countries like we should to ease the dependency on Chinese products and services. This will hurt us in the long run.

- Everything we buy and sell comes and goes by truck, if we can get a truck at any price. Inflation will continue until the country is self-sufficient in oil and gas. The current political policy may not change until 2024. Therefore, inflation will be our consistent companion for a while, then stagflation!

- There is increased concern over Mexican manufacturers gaining more business in the U.S. due to not having the Section 232 tariffs.

- We see the environment for the oil industry becoming even worse than the previous months. Biden is promoting a very caustic attitude toward the oil industry, which doesn’t help the country in any way.

And finally, this Dallas Fed respondent’s comment on the Biden admin seems to sum how many in America feel today:

“We’ll all be lucky to have a job with two more years of this disaster.”

“You can’t ignore the economic fundamentals leading to a likely recession, and the administration [in Washington] is either stubborn or as paralyzed as a deer in headlights”

“Government overspending and transfer programs have inflated the money supply while resulting in unchecked corruption and waste. We will be paying that bill for generations, and what a colossal waste of resources and missed opportunity.”

Worse still, ‘hope’ is evaporating rapidly as six-months ahead activity expectations crashed to near COVID-lockdown lows…aside from the COVID lockdown, ‘hope’ hasn’t been this weak since Lehman…

Source: Bloomberg

“Growth scare” back on…

via zerohedge