Longer-term bond yields continue to reflect an environment where inflation eventually comes back to target, and are not adequately pricing the likelihood it remains elevated and unstable.

PCE deflator data for the US is released today and we will find out how intact the current disinflationary trend is.

The trend looks set to end sooner than expected, with global inflationary forces picking back up as China recovers, reinforcing already sticky domestic inflation. If bond holders start to demand more premium to reflect a higher-inflationary world, yields will rise.

The San Francisco Fed splits up core PCE into a cyclical and acyclical component. The cyclical component is made up of those parts of the PCE that correlate well with the economy, i.e. that the Fed has more influence over with monetary policy, and acyclical is what’s left, i.e. is more globally driven.

Acyclical inflation really boils down to China, with its PPI closely matching it.

Easing in China finally looks to be getting through, with money growth and credit data showing that China is on the cusp of a cyclical upturn. The rise in yields in China shows that this upturn should lead to higher PPI in China, which should boost globally-driven inflation in the US.

Core PCE’s fall has thus far been driven by the fall in globally-driven inflation. Cyclical, aka domestically-driven, inflation is still near its highs, but even if it starts to fall as the lags from monetary policy kick in, it is likely to come when globally-driven inflation is rising again, ending the US’s trend in disinflation.

Adding to troubles, cyclical inflation itself is poised to remain sticky. One of the largest drivers of inflation’s rise was the fastest jump in profit margins seen in decades as firms took advantage of the unique circumstances of the pandemic. Even though margins have come off their highs, they’re likely to remain elevated.

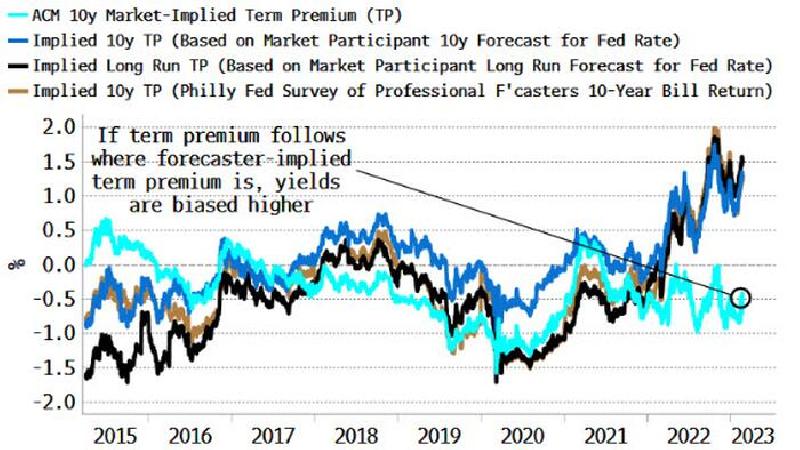

One remarkable feature of the current cycle has been how relatively contained longer-term bond yields have been despite the highest inflation for decades. Term premium has remained well-behaved, as the market has not, yet, demanded an extra premium for inflation risks.

But term premium implied by forecasters is already much more elevated than market-implied term premium. Given the inflationary backdrop, there is as yet an unpriced risk bond holders could soon start to demand a higher premium, taking yields higher.

via zerohedge