Tl;dr: The Fed hiked rates by a stunning (but expected) 75bps – the biggest hike since 1994. Esther George dissented (preferring 50bps). Fed expresses that is “strongly committed” to fighting inflation.

The Fed sharply raised its rates outlook (to meet market expectations) and sharply lowered its growth and employment outlooks.

The last time the Fed hiked 75bps, we got the ‘Tequila Crisis’ and The IMF had to bail out Mexico.

* * *

Since the last FOMC statement on May 4th, all hell has broken loose in global capital markets (and economies).

US equities have collapsed (Nasdaq -15%) and US Treasury yields have exploded higher. Gold is down around 3% since the last FOMC, mirroring the 3% or so gain the USDollar Index…(NOTE everything shifted after last Friday’s CPI)

Source: Bloomberg

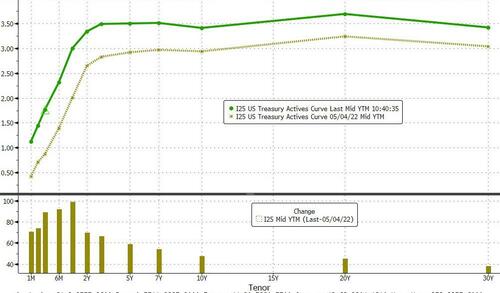

The ugliness in bond-land was led by the short-end (with 2Y yields up almost 60bps since the last FOMC and 30Y yields up 40bps)…

Source: Bloomberg

…pushing the yield curve back into inversion once again…

Source: Bloomberg

While the last FOMC statement crowed of the underlying strength of the US economy, macro data has dramatically and serially disappointed in the month or so since…

Source: Bloomberg

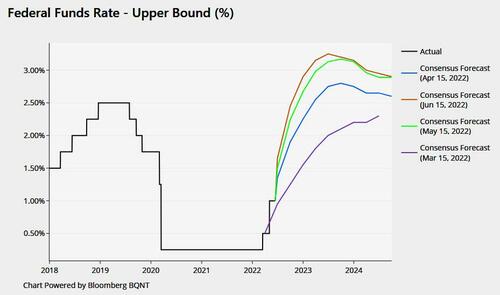

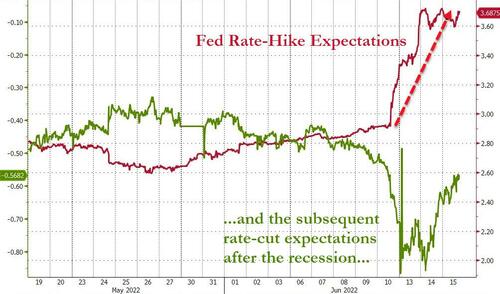

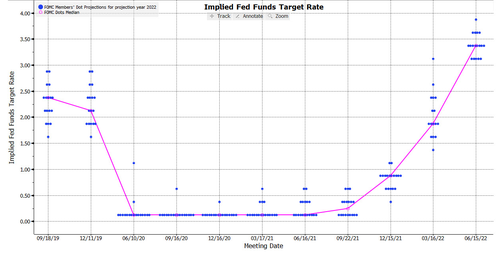

Rate-hike expectations overall have soared higher since the last FOMC statement, mostly driven in the last week post-CPI…

Source: Bloomberg

With the market now pricing in 100% odds of 75bps today and in July, and 40% chance of 75bps in September too

Source: Bloomberg

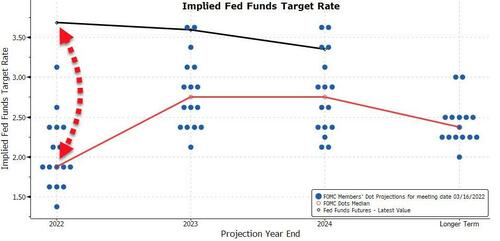

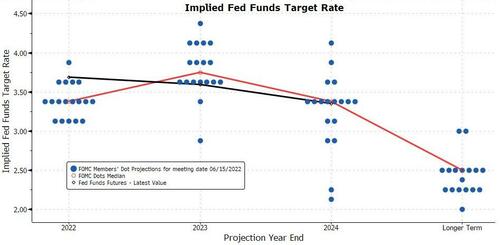

Today will also see the release of new forecasts by Fed members. The current market expectations are dramatically above The Fed’s last dot-plot, so we expect significant changes…

Source: Bloomberg

Here’s what The Fed did:

- The Fed raised its benchmark rate by 75 basis points — the biggest increase since 1994 — to a range of 1.5%-1.75%, in line with investors’ and economists’ expectations

- Kansas City Fed President Esther George dissented in favor of a 50 basis-point hike

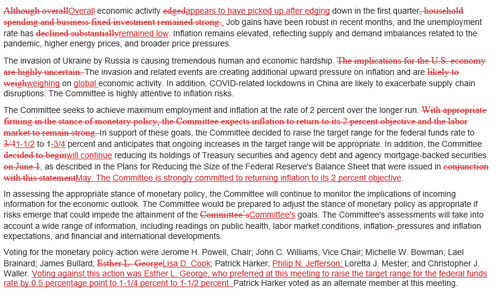

- FOMC adds a line saying it’s “strongly committed to returning inflation to its 2% objective” and removes prior language that said the FOMC “expects inflation to return to its 2% objective and the labor market to remain strong”

- Reiterates path on balance-sheet reduction that took effect June 1, shrinking bond portfolio by $47.5 billion a month and stepping up to $95 billion in September

The Fed shifted its dots up to the market…

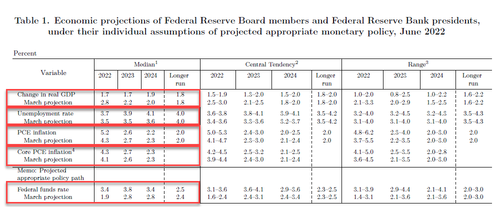

New dot-plot projections showed sharp increase from March, with federal funds target rising to 3.4% by year-end – implying another 175 basis points of tightening this year – and 3.8% in 2023, before falling to 3.4% in 2024; prior forecasts in March were for a 1.9% rate this year and 2.8% in 2023 and 2024

One crucial thing to note in the new dot-plot is that 2024 will be a year of dramatic uncertainty (and not just because of the election) with Fed members expectations ranging from a minimum of 2.0% and maximum of 4.0% – the biggest spread in FOMC history.

From “transitory” to “panic”?

Additionally, The Fed’s economic projections showed a much bumpier soft landing expected, with the unemployment rate rising from 3.7% at end-2022 to 4.1% in 2024; growth forecasts were cut to 1.7% in 2022 and 2023, from 2.8% and 2.2% in March; Fed officials still expect inflation to come down significantly in 2023

* * *

Full Redline below:

via zerohedge