The US CPI report will be the main highlight tomorrow, and will also serve as what JPMorgan calls a “market clearing event.” While the BBG median consensus expects +8.8% YoY vs. +8.6% in June, Goldman and JPM expect 8.88% and 8.7% respectively, with whisper numbers at, or above, 9.0%

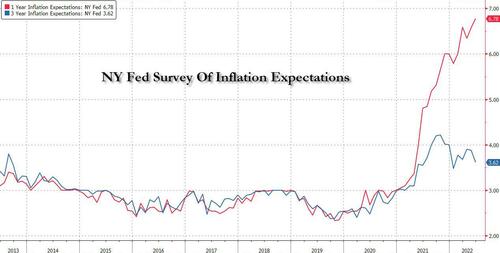

One bit of “good” news, according to Deutsche Bank, is that yesterday the NY Fed’s long-run consumer inflation expectations series showed a decent dip and helped encourage a big rally in bonds as the tug of war in the asset class continues.

Of course, much of this early optimism was reversed by today’s fake CPI report “leak” which emerged around noon and signaled a 10.2% Y/Y CPI print, but was only noticed by traders and algos in the last hour of trading, sending stocks tumbling to session lows driven by a huge sell program in a very illiquid market…

Massive sell program at exactly 3pm pic.twitter.com/Ufky5qUaSG

— zerohedge (@zerohedge) July 12, 2022

… before people pointed out that the report was i) fake and ii) had been around for hours.

So this "market" now moves off a fake CPI print which algos only noticed 3 hours after it first hit https://t.co/z6lQUe3Gzu

— zerohedge (@zerohedge) July 12, 2022

So paranoid is the market, and so gullible about “bad news” tomorrow, that none other than the US government’s Bureau of Labor Statistics had to ease traders’ nerves, saying that the “leaked” report was indeed a forgery.

“We are aware of a fake version of the June 2022 Consumer Price Index news release that is being circulated online,” BLS spokesperson Cody Parkinson told Bloomberg said in an emailed statement.

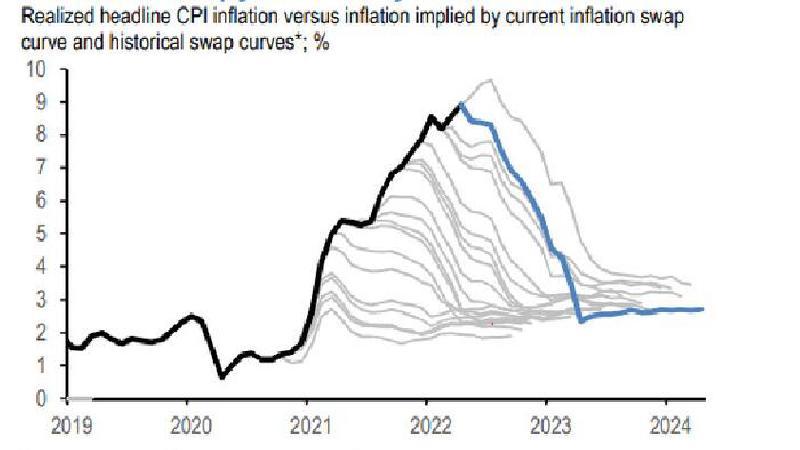

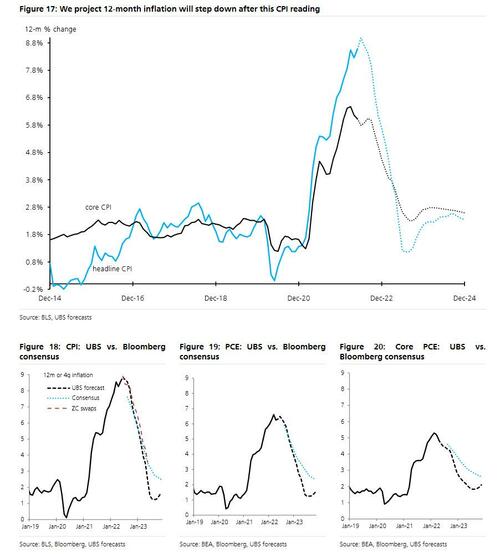

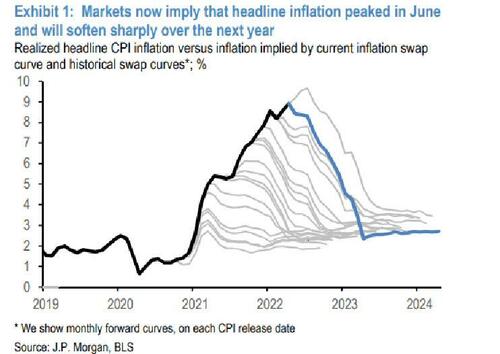

Which of course is not to say that tomorrow’s CPI print won’t be 10.2%, although that would be especially cruel. As a reminder, a on Monday we showed why a case for a sharply higher 9% headline CPI print tomorrow is possible, but that most likely will also be the peak as numbers grind lower afterwards, at least until gasoline prices soar again.

In any case, back to the forgery, none other than JPMorgan trader Andrew Tyler wrote in his EOD note (available to pro subs) that “several clients have pointed to a leaked CPI number that is circulating around social media. I have been told it is an ugly number with some suggesting that it will print above 10%. Other media sites now saying the early release is a fake.”

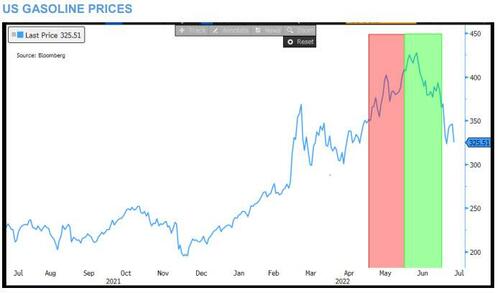

With that in mind, Tyler says to keep an eye on the energy component as we have seen a material fall in gasoline prices that will not be fully incorporated into Headline CPI, something which the White House has repeatedly said in the past two days (if forgetting that the only reason energy prices have plunged is because of the coming Biden recession).

In any case, below is a chart of gasoline with highlights for May and June price performance. Separately, Rates vol and Equity vol have divergence recently “so beware that CPI could drive both higher.”

Fake leaks aside, this is what JPM’s chief economist thinks will happen tomorrow

- JPM chief economist Michael Feroli thinks CPI prints 1.1% MoM and 8.7% YoY but given the labor market data from last week, the Fed is locked in to 75bps for July. He sees Core CPI rising 0.45%, a softer number than recent prints.

- Private Payrolls are now above February 2020 levels. JOLTS job openings fell MoM but there are approximately 1.9x job openings per each unemployed person, this compares to ~1.2x in Feb 2020.

- The Nat’l Federation of Independent Business reports that ~50% of small businesses had job openings in June with 48% saying they hiked compensation (BBG).

- Feroli updated his Fed forecast where he sees the Fed ending its hikes in December with a 3.25% – 3.50% range which means that the Fed would hike 75bps in July, 50bps in September, and then 25bps in both November and December with no further hikes in 2023.

- Many conversations surround peak inflation following the publication of the below chart from our inflation Phoebe White (full note is here). Longer-term inflation expectations have essentially round-tripped the move following the beginning of the RU/UKR conflict.

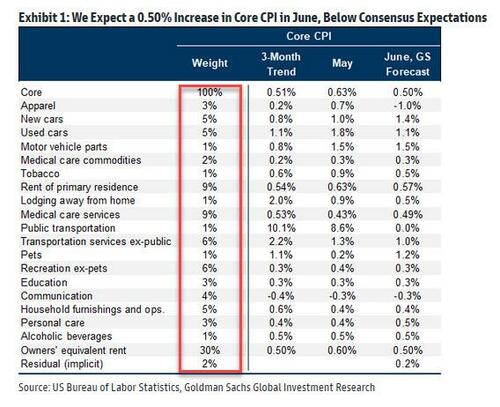

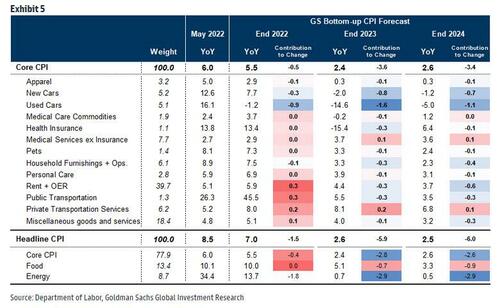

And while JPMorgan is slightly on the dovish side of the 8.8% consensus, Goldman is on the other side, with the bank today publishing a note (available to pro subs), in which it says that it expects a 1.15% increase in headline CPI in June, slightly above consensus expectations for a 1.1% increase and corresponding to a year-over-year rate of 8.88% (not 8.87% or 8.89%). On the other hand, Goldman sees slightly easier core prints with a 0.50% increase in June core CPI, below consensus expectations for a 0.6% increase and corresponding to a 0.3pp decline in the year-over-year rate to 5.71%.

Goldman highlights four key component-level trends for the June report:

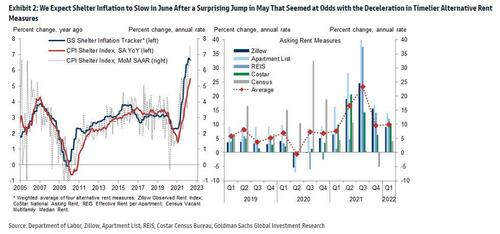

1. Shelter. The most important category to watch in Wednesday’s report is the large and persistent shelter component (as we predicted it would be last summer when the macro-tourists, perma-idiots and other central bankers were still saying inflation would be transitory), which accelerated unexpectedly to its fastest monthly pace since 1991 in May. Goldman expects sequentially slower shelter inflation in the June report (rent +0.57% and OER 0.50%), reflecting slowing gains in the alternative rent measures that make up our shelter tracker and an OER drag from imputed utilities.

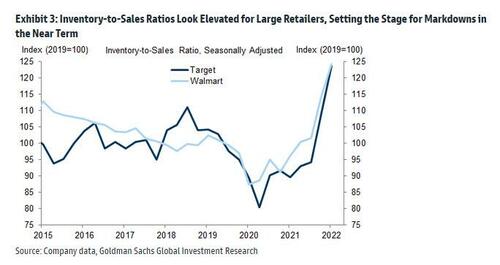

2. Nondurable goods or the bullwhip effect. Following the product shortages of 2021, inventories have now substantially overshot their pre-pandemic levels at large retailers like Target and Walmart. Some companies have already said that they anticipate cutting prices in coming months in order to reduce inventory stocks to more normal levels, and Goldman expects to see a 1% drop in apparel prices in June.

3. Auto and parts. On the other side, expect further increases in auto prices (new +1.4%, used +1.1%, parts +1.5%) due to continued global supply disruptions, most notably the Ukraine-Russia war and China lockdowns. US automakers have been more optimistic about raising production later this year, which should eventually lead to more moderate growth in new car prices.

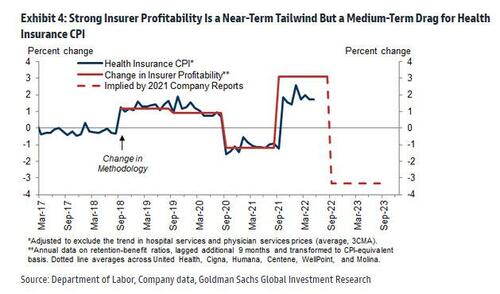

4. Health care. The CPI’s health insurance component closely tracks annual changes in insurer profitability. Goldman forecasted the sharp acceleration seen this year last fall based on the insurer data, and expects this small category to continue to make an outsized contribution until new insurer data are incorporated in October, at which point it is likely to turn quite negative for the next year. Goldman forecasts a +0.49% (mom sa) increase in medical services prices this month.

Going forward, Goldman expects monthly core CPI inflation to remain strong in late summer, picking back up to 0.53% in September, before eventually falling to 0.30% by December 2022. Absent a major recession (or depression), the bank forecasts year-on-year core CPI inflation of 5.5% in December 2022, 2.4% in December 2023, and 2.6% in December 2024. The forecast reflects a negative swing in health insurance prices and a larger slowdown in goods than in services inflation next year.